With the introduction of computers in trade, its volume has increased manifold. More volume of trade is carried out in an hour nowadays than was carried out in an entire week earlier. The number of traders has increased too, and hence one needs to be careful with the person we authorize to handle our money. You never know the kind of trap you might fall into. Only felügyelet alatt álló bróker services should be hired to minimize the risk that you stand with each investment. Now how can you know if a person is going to be responsible with the task you ensure his/her with? Obviously there is no hard and fast rule for this. We just try to be as sure as we can be when it comes to it. Try to minimize the chances of you regretting your decision, be responsible in considering your options.

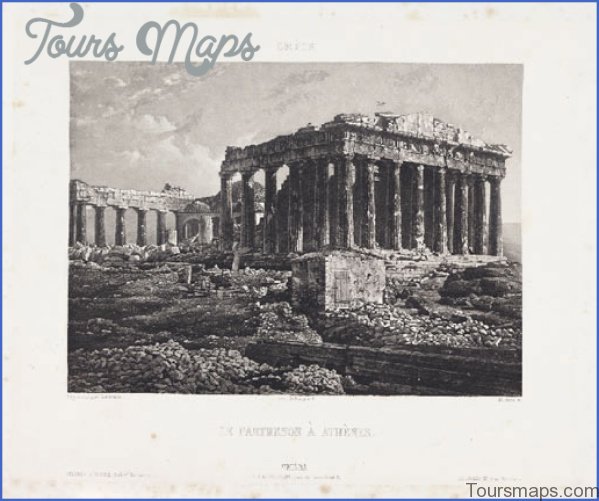

Operating Faithfully and Securely: A Felügyelet Alatt álló Bróker Photo Gallery

Reasons to go the extra mile:

Of course it is an additional task to look for someone who is ready to work under constant supervision. But you should make this effort for the number of benefits that come with it. A few of them are being listed below for the consideration of the reader:

Advertising compliance: The biggest trap that is laid out for the unsuspecting investors is in form of false advertising promises. Fraudulent traders publish unrealistic assumptions and conditions to lure the investor into a trap and then bind him to a security or a share that she/he might not have wanted to deal in. Thus, you are forced to bear the loss of a decision that was not even yours. On the other hand, if you would have approached a felügyelet alatt álló broker you would have an authority to complain to. Even the broker would have been bound to making good on his promise.

Element of the unknown: In matters of money, it is best that we exercise every due caution that we can think of. Money is a hard earned resource and no one would like to just give it away to the first person that makes pretty promises. Having a body to approach to know about a broker beforehand can be of a great help. You can check his/her rating and decide for yourself if the person is good enough for your trust. It also rules out the element of unnecessary risk. In older days, there was no way of knowing the good ones from the bad and the only authority that one could trust was the word of mouth which, again, can be easily forged.

Administrative control: You retain complete control over the management of your fund. The broker cannot keep your amount locked in any longer than your consent. In a time of emergency it might become necessary to liquidate your assets to arrange for cash. Scrupulous traders will not object to your demand but who does not have any authority to report to might try to get his way with the pattern of your investments. Other examples include, moving around money without informing the owner or indulging in stock gambling with the funds of investors. All such practices are barred under supervised brokerage. Any individual caught practicing such activities is not only penalized but also debarred from trading in shares.

Ease of control: If you are an investor who likes to deal in different portfolios to decrease your risks, then chances are that you hire different brokers to handle each account. If you hire the services of a registered body of stock traders, all your needs will be addressed at a single window. You will end up saving both time and money. But in absence of a felügyelet alatt álló bróker, you will have to allot individual time to each party to monitor their activities and supervise their investment pattern. Lack of accountability gives freedom to people which they might or might not use in a correct manner.

Monitoring the license: The importance of license for the brokers is made evident when we have to find out about the validity of their operations. An expired or suspended license can have different repercussions that we might not be ready to deal with. A suspended license is evidence of wrongdoing and malpractice. Having a felügyelet alatt álló bróker rules out such risks, the body of governance that presides over them ensures that only honest and valid brokers handle your money. If such a person fails to pay or notify you, you possess the right to hold him/her responsible. On the other hand, an unsupervised trader might or might not possess the validation and can gamble with your money without your knowledge.

Insurance against theft: Many people associate paying additional taxes that come with the hiring of a supervised brokerage service negatively. But it is not so, it is the money that you pay to ensure that all activities that you are indulging in is completely regulated and operates within the confines of law. Accountability towards the people it deals with should be its duty, not a favor. To save a little money, it will be unwise to indulge in a greater risk than plausible. The trading in stocks and securities comes with risks of its own; you should not be taking on anymore additionally.

Mind over matter:

Going through the above mentioned points, the need for a felügyelet alatt álló bróker should have become evident to you. You have spent significant time and effort to be where you are today. Do not let a foolish gamble take it all away from you; it is not very easy to find second turn in the financial securities market. Any decision that you make should be carefully thought out and planned keeping in mind the risk that you stand to face. Many brokers rue working under a constant watch and complain that it limits their freedom of operation. But then that is the point, to keep them within check and prevent them from indulging in a risk inviting behavior.

Maybe You Like Them Too

- Top 10 Islands You Can Buy

- Top 10 Underrated Asian Cities 2023

- Top 10 Reasons Upsizing Will Be a Huge Travel Trend

- Top 10 Scuba Diving Destinations

- World’s 10 Best Places To Visit