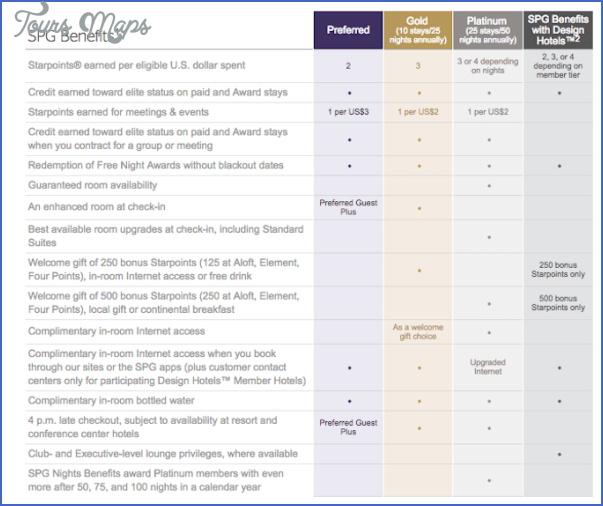

Mileage / Loyalty Points. For every fixed amount spent, you accrue points which can then be redeemed for airline frequent flyer points or hotel loyalty / reward points. By now, you would have guessed that the difference between Platinum (or higher) and lesser category cards is the rate of earning. Higher the card type, faster is the rate of earning miles and points.

Lounge Access at Airports. You get free access to lounges at the airports. Most of them are located at the airside (after security check). They offer comfortable seating, computers and / or tablets with Internet access, reading material and food & beverages all day long – all of it free! So not only you save money, you get some privacy and exclusivity too. For smart schmoozers, you can get into your networking mode and make contacts with other high-fliers! I have explained airline lounges in Chapter 2, in detail.

Discounts. You get discounts or promotional offers on airline tickets, hotel stays, restaurants, golf courses and more. These discounts may be seasonal (e.g. Diwali) or in the lean season (e.g. August / September).

Complimentary Insurance & Card Protection. The bank or card issuer will provide air insurance cover ranging from Rs. 30 Lakhs to 2 Crores. Moreover, you will also be protected by card protection plan against any fraudulent purchases against your card.

Other Offers. You may get invitation to several events like concerts or fashion shows, tickets to movies and shopping discounts and much more.

Deference. Yes, you read that right. You flash your Platinum / Signature or higher card and you automatically see the change in behavior in many cashiers who recognize it – if you picture Richard Gere in Pretty Woman, you will get what I mean.

Benefits of Platinum & Other Premium Credit Cards For India Photo Gallery

Maybe You Like Them Too

- Aman-i-Khas Ranthambore National Park, India

- Where is Deolali, India? – Deolali, India Map – Deolali, India Map Download Free

- Is India the World’s Unknown Beer Destination?

- Visit to India

- YOUR INDIA TRAVEL ORGANIZER